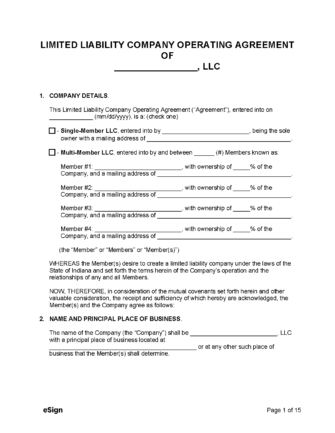

An Indiana LLC operating agreement describes the structure, procedures, and regulations put in place by the owner(s) upon founding a limited liability company. The document allows members of the company to establish their role and duties, as well as list their respective ownership percentages, and separate them from the company thus eliminating or reducing personal liability.

Completing an operating agreement is not required by law when registering a new LLC, though it will aid considerably in avoiding internal disputes and clarifying the business structure.

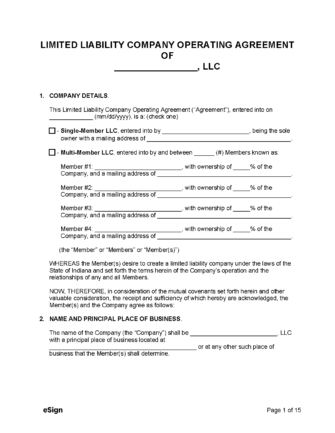

Single-Member – Allows an individual to complete an operating agreement for their LLC.

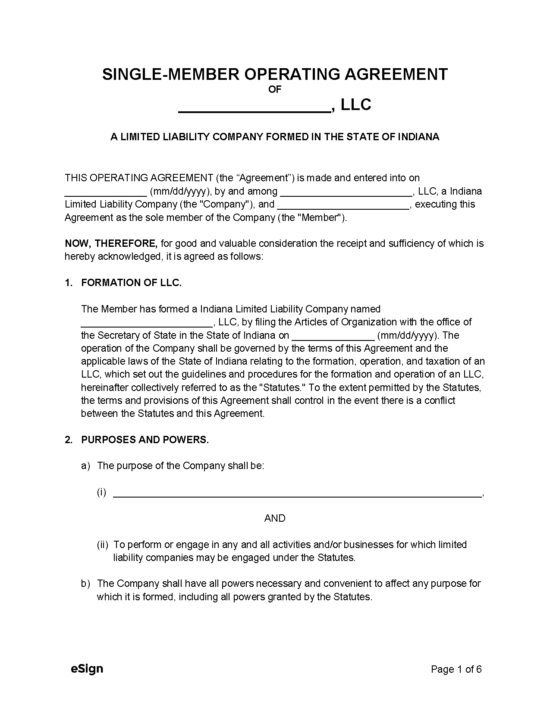

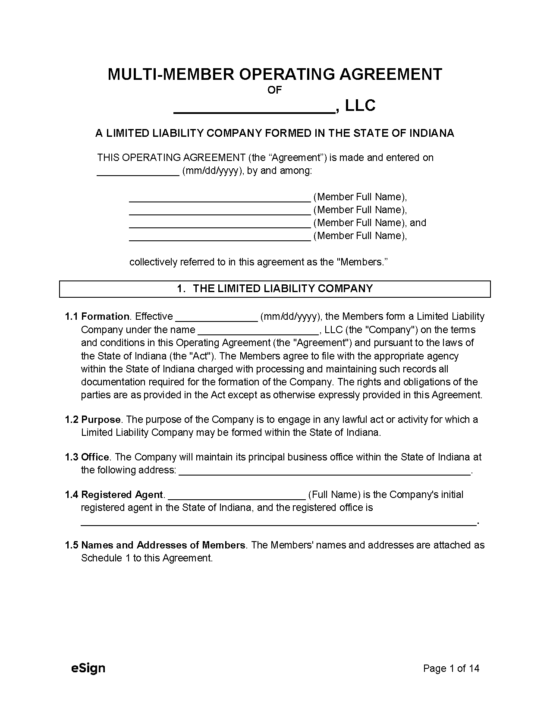

Multi-Member – This form binds members of an LLC to the specifics of how their company will operate.

The first action when creating a limited liability company is selecting a name not yet registered with the Secretary of State. The name must include one of the following: “limited liability company,” “LLC,” or “L.L.C.”

Existing businesses may be searched via the Indiana INbiz website as initial name availability check. It is important to note that the availability of a selected name cannot be guaranteed until the LLC’s Articles of Formation are submitted and processed.

Individuals may choose to submit an online application (see below) to reserve a name before registering their company. A $20 fee is required for name reservations, the submission of which grants exclusive rights to the name for one hundred and twenty (120) days.

Users will need to create an account on the InBIZ website to access the name reservation application. The same account will be used to begin the LLC registration process and access InBIZ online resources.

The LLC will be required to nominate a registered agent, the individual or business entity to serve as the legal representative and contact for the company. The registered agent must maintain a business address in the state, which must be identical to their office address. The LLC cannot be its own agent, although members of the company may be nominated.

Filing the Articles of Organization or Foreign Registration Statement is a key aspect in forming a limited liability company. Once the documents are received, accepted, and processed by the Secretary of State, the company is established as a legal entity and may begin its business operations.

File by Mail

File Online

File by Mail

An operating agreement presents an overview of an LLC’s structure and how it will conduct its business operations. Entering into an operating agreement is an optional step when forming an LLC but it is greatly recommended as it provides security from personal financial liability or disagreements between members.

An EIN (Employer Identification Number) is an identification tool issued by the IRS for business tax reporting purposes. Multi-member LLCs are always required to apply for an EIN, while single-member LLCs will only require an EIN if their business will have employees or if the owner opts to file their taxes as a corporation rather than a sole proprietorship.

The EIN application process is started by selecting Begin Application on the IRS website. The IRS also provides a printable Application for Employer Identification Number (Form SS-4) for mailed or faxed filings. The printed form may be delivered via:

Additional information for EIN applications can be found here.

Costs:

Forms:

Links: